Engage, strategise, innovate, report

Your ESG journey redefined

Redefining your journey in sustainability

Discover why we are your premier choice for seamlessly integrating sustainability into your business strategy, navigating ESG requirements, driving innovation with circular economy principles, and enhancing your team's skills.

Tailored sustainability guidance

Explore how FutureWise Partners can assist you at every stage of your sustainability journey

Strategy & Governance

Embed sustainability at the heart of your strategy

Resilient investments

Navigate investments with climate-driven insights

Supply Chains

Enhance supply chain transparency and innovation through collaboration

Transparent reporting

Build trust and credibility with stakeholders through reporting

Trainings & Workshops

Align your leadership to drive sustainability across functions

01

Sustainability strategy and governance

Embed sustainability at the heart of your strategy

Unlock your business's full potential by integrating sustainability from a mere requirement to a core strategic asset, leveraging our expertise to transform environmental, social, and governance challenges into avenues of growth and innovation.

In the current climate of rapid market evolution, sustainability transcends regulatory compliance to become a pivotal business driver.

Amidst increasing expectations from clients, investors, and regulators, forward-thinking companies are elevating sustainability to a core strategic lever.

By integrating Environmental, Social, and Governance (ESG) considerations into business operations, forward-looking firms are not just managing costs and risks; they're also unlocking new opportunities, enhancing stakeholder trust, and cementing their market position.

Strategic sustainability is not about ticking boxes but about charting a course for long-term success.

Global frameworks such as those from the Global Reporting Initiative, the European Union's Corporate Sustainability Reporting Directive with its European Sustainability Reporting Standards, and the International Sustainability Standards Board serve as compasses in this endeavour.

These frameworks don’t just guide reporting; they empower corporations to align sustainability initiatives with their long-term business goals and the looming horizon of regulatory expectations.

Our services

Coherent sustainability pathways

We specialise in making the complex world of sustainability standards straightforward. Our role is to fit the pieces together, crafting a coherent journey that makes sense for your business now and in the future, aligning with both market expectations and regulatory requirements.

02

Resilient investment and financial strategies

Navigate investments with climate-driven insights

Equip yourself with cutting-edge strategies to navigate the rapidly evolving landscape of sustainable finance.

CFOs and investors are increasingly challenged by the need to integrate sustainability into their financial strategies amid rising stakeholder scrutiny and evolving regulations.

This new layer of complexity comes when resources are stretched thin, making it crucial to integrate these requirements efficiently while maintaining financial performance.

- Proven track record

- Financial acumen

- Continuous certifications

- Trainer in Sustainable Finance workshops

- Strategic vision

How we transform challenges into opportunities

Some examples of our work in financial strategies

Advancing ESG performance through robust scoring models

Challenge

The client, a major global

insurance company, sought a

unified approach to assess their

entire capital investments (7bn €) according to ESG principles.

The goal was to shift their portfolio of stocks, government, and corporate bonds towards

greater sustainability.

Solution

An extensive stakeholder

engagement process, involving

more than 70 experts from 40

reputable organisations

(scientists, economists, and

NGOs) to shortlist key ESG

indicators. A comprehensive ESG scoring model was built based on this process, allowing to assess the ESG performance of over 18,000 individual positions from 600 issuers.

Results

The cooperation has set an important precedent in the insurance sector, showcasing how strategic partnerships can drive significant advancements in sustainability. For the client, basing their investment strategy on “ESG integration” made the entire capital investments transparent and allowed for target setting. The project won the reputable TRIGOS Award in 2015.

Integrating sustainability into investment management at a major CEE bank

Challenge

A major Central and Eastern

European (CEE) bank was seeking to direct investments towards environmentally beneficial projects, offering their customers a “green” alternative to conventional investments.

Solution

An asset management approach that reviewed assets according to strict WWF criteria. The approach combined “negative screening”

(where certain sectors and

products were entirely excluded

from the portfolio) with

“sustainability-themed investing”, directing funds towards sustainable products and services). The decision of including an asset into the investment portfolio was ultimately taken by an independent stakeholder council, consisting of experts in

the fields of E, S and G.

Results

This project was one of the

pioneering initiatives in Austria

to integrate sustainability into

financial products.

As the first-of-its-kind

cooperation between an NGO

and a financial institution in

Austria, it helped raise awareness about the importance of sustainable investments.

03

Sustainability in supply chains

& circular business models

Enhance supply chain transparency and innovation through collaboration

Incorporate circular economy principles to enhance your sustainability strategy and unlock new opportunities for growth and resilience.

With increasing demand on resources, traditional linear production and consumption models are becoming increasingly unsustainable. Companies are under pressure by various stakeholders to minimise waste across the value chain and make their production more circular.

Circular economy enables reduce dependence on virgin resources, innovate through new business models, save costs and manage better waste management practices. This approach provides companies a unique opportunity to innovate across different stages of their value chain.

Our solutions

Your Circular Transformation Roadmap

04

Transparent reporting

Build trust and credibility with stakeholders through reporting

Business leaders are tasked with integrating sustainability across the organisation and developing action plans. They must ensure workforce readiness, regulatory compliance, and truthful stakeholder communication.

Balancing these complex requirements is crucial for maintaining brand reputation and meeting stakeholder expectations, contributing to the effectiveness and legitimacy of sustainability initiatives

- Expertise in sustainability and reporting: Developed 40+ sustainability reports following GRI, SASB, regional reporting requirements and ESG ratings

- Communication and interpersonal skills: Extensive experience in stakeholder engagement and collaboration, effectively communicating complex sustainability concepts.

How we transform challenges into opportunities

Sustainability reporting

05

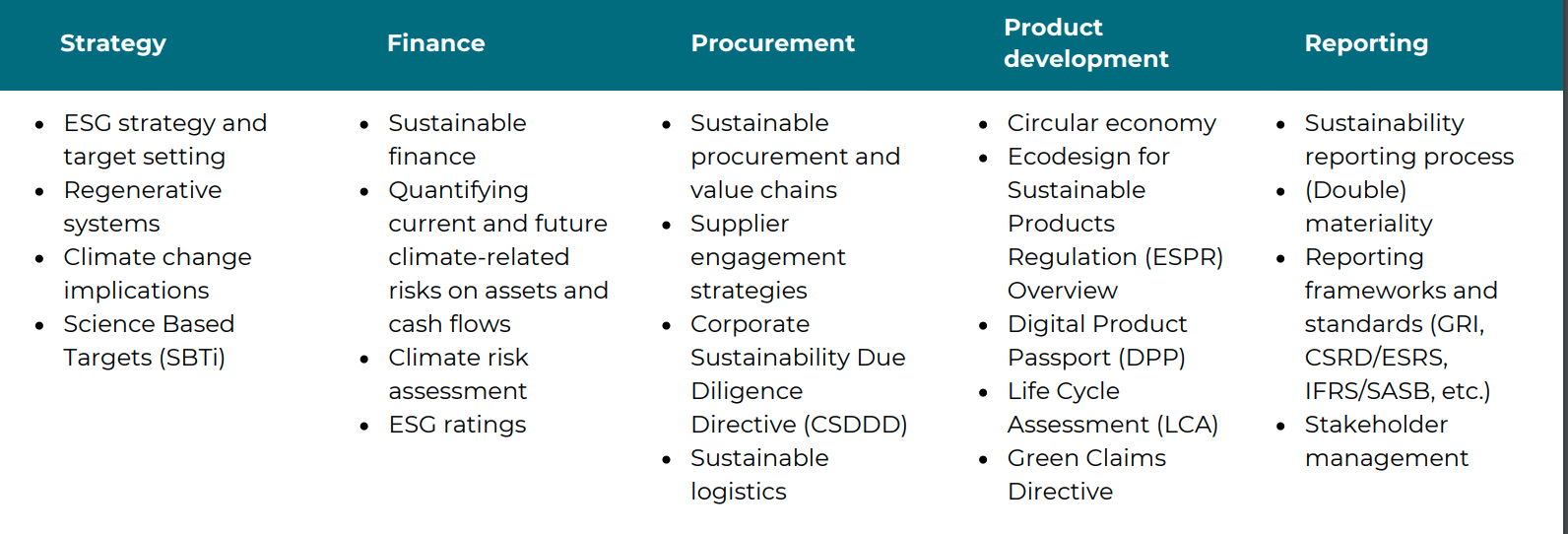

Training and upskilling workshops

Align your leadership to drive sustainability across functions

Equip your team with the insights to turn sustainability into competitive advantage through our targeted workshops and training sessions.

Many organisations aim to align their strategies with sustainability goals but often lack the in-depth knowledge needed for effective implementation.

Something that it should be for all the divisions of the company

Training and development experience

- Developed and implemented engaging training programs for C-level and middle management of corporate and financial institutions, as well as startups, across Europe, UK and the Middle East.

- Faculty member in Sustainability Marketing at the Gabelli School of Business (Fordham University, London).

Communication and interpersonal skills: Extensive experience in stakeholder engagement and collaboration, effectively communicating complex sustainability concepts.

How we transform challenges into opportunities

Train and empower your employees to become agents of change

Training and upskilling workshops

FutureWise partners support you in your certification process

Highlight your commitments

You’d like to get a net-zero validation, obtaining Ecovadis certification, or pursuing B Lab certification for B Corp status ?

Certification guidance

We collaborate with your team to identify the most suitable sustainability reporting and certification pathways for your organization. Our guidance ensures alignment with your goals and values.

Are you ready to act?

We have the tools and knowledge for a sustainable future.

The next step is yours.

FutureWise Partners

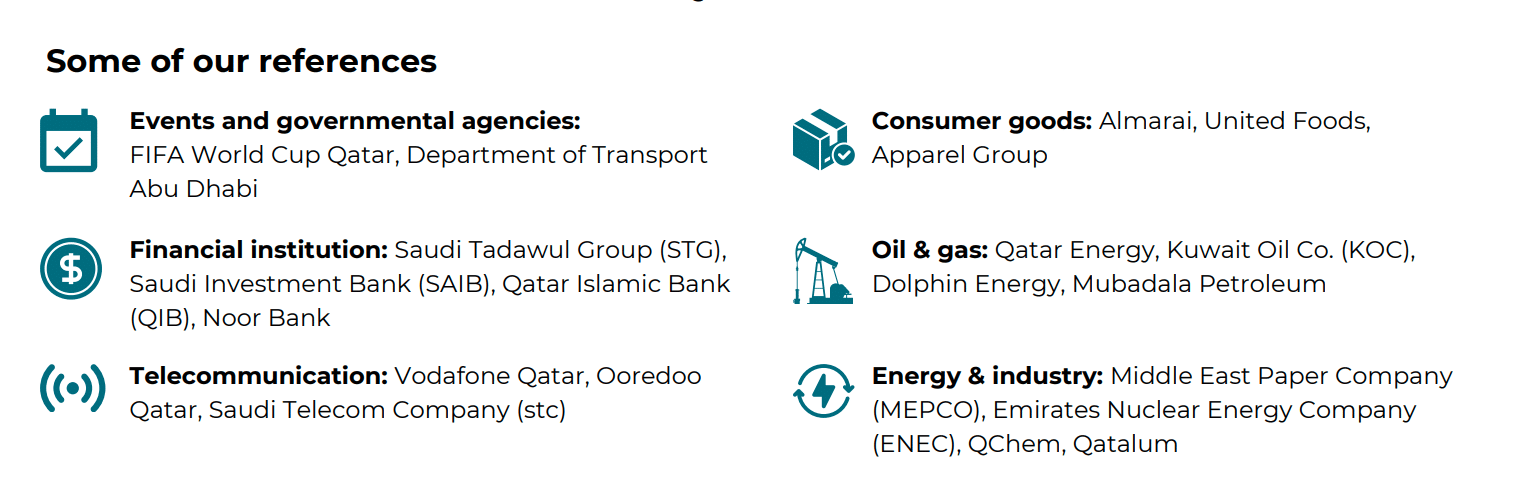

FutureWise Partners is a boutique consulting firm operating under a partnership model in the United Kingdom, Belgium, Austria, and Türkiye.

Our vision is a world where corporations and asset owners transition their operating models towards a regenerative future – a future where business practices and societal progress harmoniously regenerate and restore the environment and communities.

Services

Approach

©2023 FutureWise Partners - Site created by IdeaPixel.fr

We are committed to making our website accessible to all users, including those with disabilities.